Strategic Goals

for years 2021-2024.

Basic goals

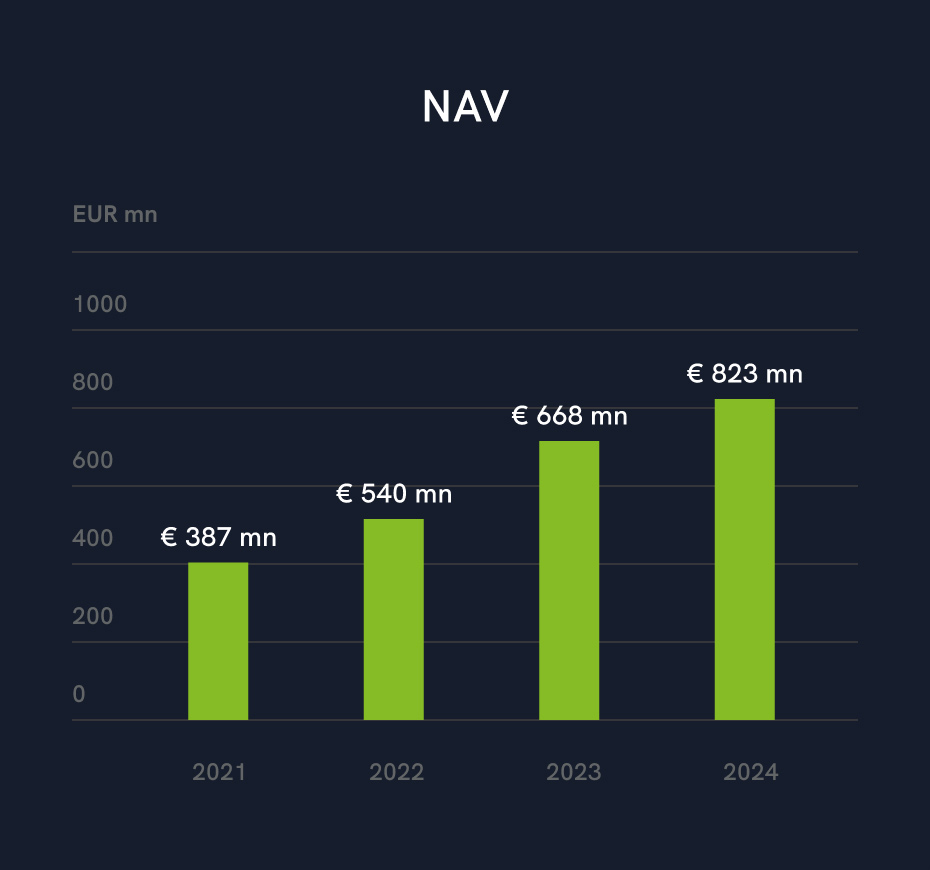

double NAV value from 2021 by year 2024 and consequently exceed EUR 800 million at the end of 2024

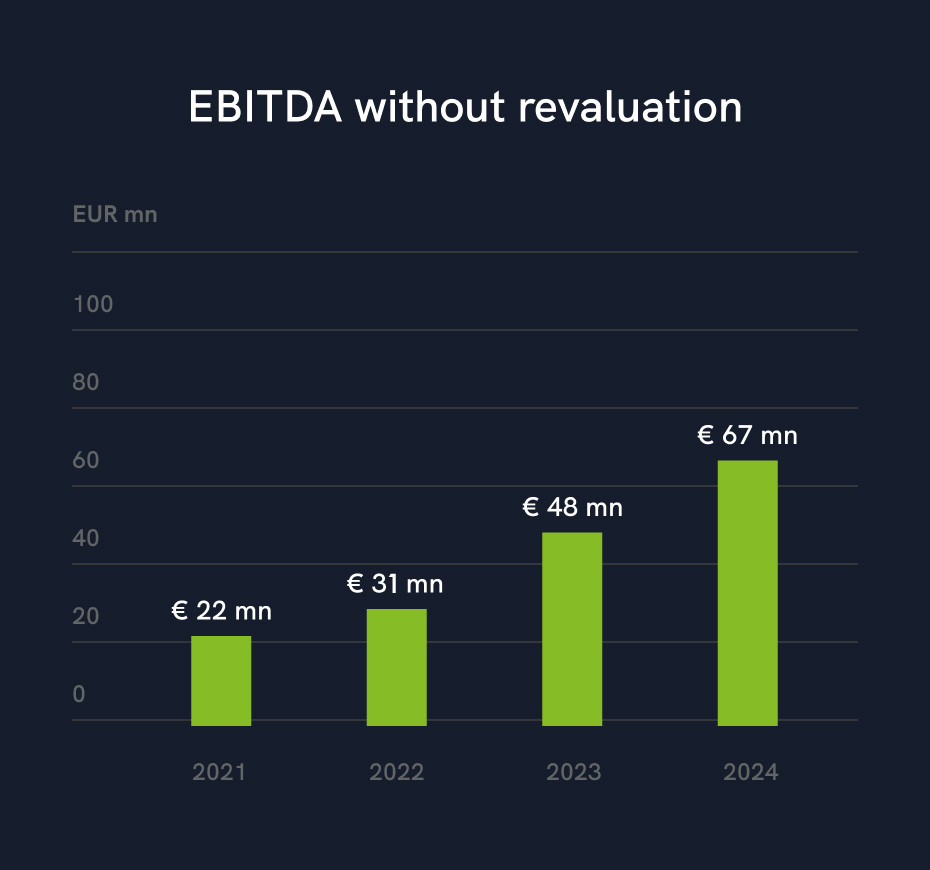

triple the amount of EBITDA excluding revaluation, reaching app EUR 67 million in 2024

organic growth approx. 35% yearly

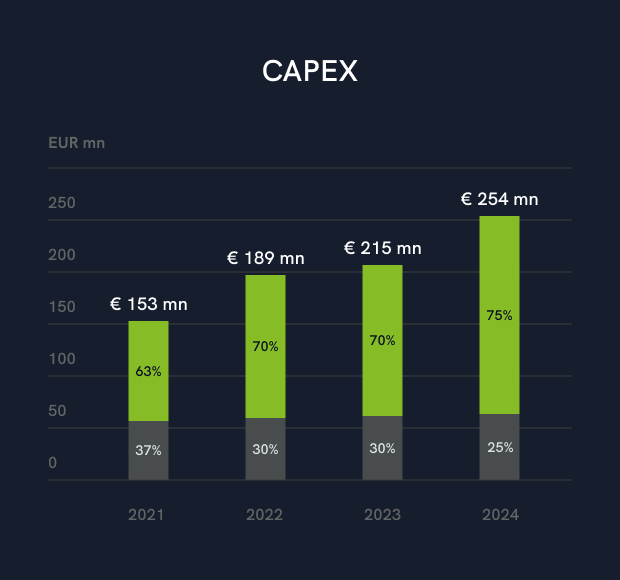

To meet those strategic goals MLPG will need to invest yearly CAPEX of app EUR 150 million – EUR 250 million into land acquisitions and new buildings constructions.

The CAPEX will be financed by banking loans, corporate debt, and issue of app 2,600,000 new shares (planned to be issued in 2022).

MLPG will keep LTV below 50%.

MLPG will continue its current “build and hold” strategy while keeping LTV below 50%.

Additional goals

Building economic scale in the existing strategic markets - Poland, Germany, Austria, and Romania through developing of urban logistic and big-box projects

Analysing and investing in new potential markets addressing the tenants’ needs and ecommerce development

Maintaining stable occupancy rate averaging ~ 95% of total existing portfolio with speculative development component of up to 20ksqm per project

Increasing annual leasing take-up from 125k sqm to 250k sqm annually

Securing new plots for future development in existing and new markets

Continuing the development of big-box projects primary addressing ecommerce development and light industry requirements following the increase demands as from moving manufacturing from Asia to Europe

Focusing on urban logistic as a high growth potential product – addressing the retail evolution (e-commerce) with: smaller units, less than 5000 sqm, located within or close to city boundaries with easy access to labour and public transportation

- diverse range of uses: last mile delivery, light assembling lines, data centres, distribution points for retailers (online and traditional), parcel delivery companies, small business units and wholesalers

- expectation for an increase demand because of growth of digital economy

- lower price competition and better yields

- smaller units are better accepted by municipalities in comparison to Big-Box as it is served with less heavy trucks and provide more employments opportunities for white and blue collar personnel.

- speculative construction is a must

Rental growth from existing lease renewals

Creating value through re-development of brown plots (e.g. UNNA, Schwaltmal, Gelsenkirchen, Idstein, Poznań)

Disposal of BTS projects, a source of additional equity

Developing of class-A asset quality, with strong commitment to sustainability: 80% to be certified BREEAM Excellent or Very Good / DGNB Gold or Platinum (DE and AT) and Zero CO2 emission in 2 – 3 years

Additional goals

Significant growth in 2022 Germany/Austria NAV results from development of projects secured in 2019/2020

Growth in rental income results from new rentals, increase of rent in renewals of current lease agreements and maintaining 99% retention rate.

Increase in unit construction costs is reflected in rentals growth.

FFO growth is related to growth in the portfolio and continuous decrease in financial costs due to portfolio refinancing

Primary goals for photovoltaic installations

Poland

- Until end of 2022 installation of approximately 6,3 MWp of total power in 11 MLP Parks (14 thousand units), 100k sq m of roofs.

- Expected income of approx. 910k EUR

Germany & Austria

- MLP Business Park Berlin 750 kWp

- Expected income 60k EUR

- MLP Unna 650 kWp

- MLP Business Park Wien 700 kWp

- Expected income of approx. 100k EUR

- Installation of 8 MWp of total power in existing and new parks at 150k sq m of roofs

- Expected income of approx. 1,700k EUR

- Expected installation in new parks in Poland - 3MWp

- Expected income of approx. 430k EUR

- Expected installation in new parks In Germany – 2MWp

- Expected income – 130k EUR

- Expected income of approx. 2,605k EUR yearly

Disclaimer

This presentation has been prepared by the management board of MLP Group S.A. with its registered office in Pruszków, Poland (the “Company”, the “Issuer”) as publicly disclosed information concerning the company’s strategy, as adopted by the Company’s board on 17 November 2021.

This presentation does not constitute, in whole or in part, and should not be construed as an offer to sell, a solicitation or invitation to buy or subscribe for securities of the Company in any jurisdiction or a solicitation of investment business. No part of this presentation or the fact of its distribution shall form the basis of or be relied upon in connection with any contract, commitment or investment decision.

Market data and certain economic or sector data and statements in this presentation regarding the Company and its subsidiaries’ (the “Group”) position in the sector have been estimated and derived from assumptions the board of the Company believes to be reasonable and its own research, surveys or research conducted by third parties or from publicly available sources, sector or general publications.

The information contained in this presentation that have been sourced from third party publications or publicly available data published by public authorities, had not been independently verified. No representation or warranty, expressed or implied, is made or should be relied upon as to the reliability, accuracy, completeness or correctness of such information or opinions contained in this presentation. This presentation is not intended to be a substitute for independent judgment. Neither the Company nor any of its affiliates, advisors or representatives accepts any liability (whether in negligence or otherwise) for any loss which arises from the use of this presentation or its contents or which arise in connection with the presentation.

The Company’s shares have not been and will not be registered under the U.S. Securities Act of 1933, as amended, and accordingly may not be offered or sold in the United States. Further distribution of this presentation and related information may be restricted by law in certain countries. Failure to comply with such restrictions may constitute a violation of the securities laws of such jurisdiction.

This presentation does not constitute a recommendation regarding investment decision (regardless such decision content) referring to investment in any securities of the Company.

This presentation is intended to present the expectations of the board of the Company regarding the future development of the Group’s business and strategic business and financial objectives that the Group intends to achieve. Therefore, the presentation contains forward-looking statements. Such statements include words such as: “anticipates”, “believes”, “intends”, “estimates”, “expects” and words of similar meaning. All statements other than statements of historical fact contained in this presentation, including, but not limited to, statements regarding the Company’s financial condition, business strategy, plans and objectives of management regarding the Group’s future operations, are forward-looking statements. Forward-looking statements, cannot been qualified as “true” or “false” since such statement, do not refer to the actual facts but to the uncertain future development business of the Group as well as of the future business environment that will affect Group’s business and will verify or falsify the assumptions made by the board of the Company while defining the strategy of the Group. The future involves a number of known and unknown risks, uncertainties and other important factors that could affect the Group’s performance, level of activity and objectives, and cause them to differ materially from the expected future results expressed in the forward-looking statements. Forward-looking statements are based on a number of assumptions regarding the Group’s current and future strategies and the environment in which the Group will operate in the future. Forward-looking statements have been formulated in good faith and in accordance with assumptions current as of the date of this presentation. The Company undertakes no obligation to update or revise any forward-looking statements contained in this presentation should there be any change in the Company’s expectations regarding the future or should there be any change in events, conditions or other circumstances on which the forward-looking statements are based.

The Company cautions that forward-looking statements are not guarantees of future performance and that actual financial condition, business strategy, plans and management’s intentions with respect to the Group’s future operations may differ materially from those indicated or implied by the forward-looking statements contained in this presentation. Furthermore, even if the Company’s future financial condition, business strategy, plans and management’s intentions with respect to the Group’s future operations are consistent with the forward-looking statements in this presentation, the achievement of these results should not be relied upon as a guide to the results that will be achieved in future periods. Subject to obligations pursuant to the applicable reporting stands the Company undertakes no obligation to revise, confirm or release any updates to any forward-looking statements in the event of any changes which occur after the date of this presentation.

The strategic goals presentation assumes FX rate in the range of 1EUR = PLN 4.50 – PLN 4.60

The information and opinions contained in this presentation are prepared as for the date of this presentation and are subject to changes, which will not be communicated by the Company.

Dividend distribution is not taken into account in this assumption. Any dividend distribution will require an increase in the issue amounts or a reduction in investments.

Consequences of the contemplated changes in the Polish tax law by the Polish government under the title “Polish New Deal” (Polish: Polski Nowy Ład) are not taken into account since these changes are, at the moment, still subject to further discussions and changes and as such are difficult to predict.

MLP also assumes that Poland will remain in the European Union, that no economic sanctions will be imposed on Poland and Poland will remain part of the Schengen Area.